[Live Prices USD]

Gold: |

Silver: |

Platinum: |

Palladium: |

Gold To Silver Ratio:

What makes gold a strategic asset?

Gold benefits from diverse sources of demand: as an investment, a reserve asset, jewelry, and a technology component. It is highly liquid, no one’s liability, carries no credit risk, and is scarce, historically preserving its value over time.

How to value gold for maximum portfolio impact Gold does not directly conform to the majority of the most common valuation methodologies used for equities or bonds. Without a coupon or dividend, typical models based on discounted cash flows, expected earnings, or book-to-value ratios, struggle to supply an appropriate assessment for gold’s underlying value. This presented an opportunity for the World Gold Council to develop a framework to better understand gold valuation.

What is the Gold Valuation Framework (GVF)?

GVF is a methodology that allows investors to understand the drivers of gold demand and supply and, based on market equilibrium, estimate their impact on price performance.

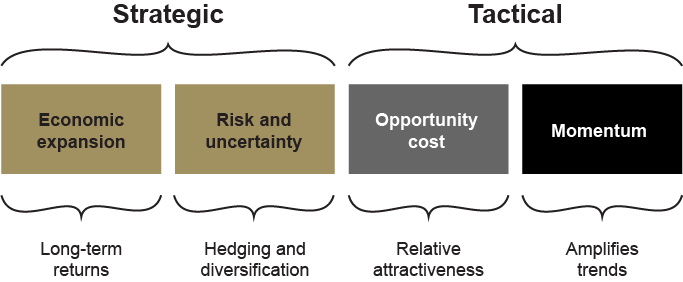

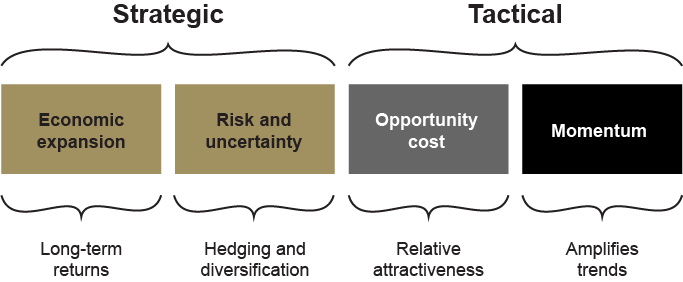

Our analysis shows that the price performance of gold can be explained by the interaction of four key drivers:

- Economic expansion: periods of growth are very supportive of jewelry, technology and long-term savings

- Risk and uncertainty: market downturns often boost investment demand for gold as a safe haven

- Opportunity cost: the price of competing assets, especially bonds (through interest rates) and currencies, influences investor attitudes towards gold

- Momentum: capital flows, positioning and price trends can boost or dampen gold's performance.

Returns

Diversification

Liquidity

Performance